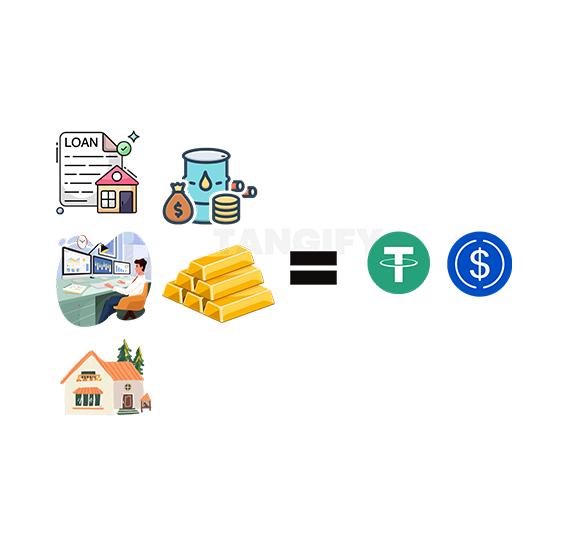

Borrow underline decoration-dotted stablecoin at ease with you Physical Assets

Access funds without selling your valuable assets.

Quick processing and approval of loans.

Choose loan terms that suit your financial needs.

Using trust standard like ERC-3643 we have made it secure and realiable and easy for Lenders. Here are some benefits:-

Lend against a variety of your stablecoins

Smart Contracts & Use of Standardized ERC-3643 for Robust Security

Earn interest on loans backed by tangible assets.

Welcome to Tangify, the revolutionary DeFi protocol that bridges the gap between physical assets and digital finance. With Tangify, you can leverage your tangible assets to borrow funds quickly and securely, all while maintaining full control and ownership.

Submit details of your physical asset. Our experts verify and tokenize your asset using the ERC-3643 standard.

Use these tokens as collateral to borrow funds.

Borrow against your tokenized asset. Use the borrowed funds for your needs.

Repay the loan as per agreed terms.Redeem your physical asset upon repayment.

There are many variations of passages of Lorem Ipsum available but the majority have suffered alteration in some form.

The Future of Lending and Borrowing with Real-World Assets

2024